Embark on a journey to conquer the intricacies of adjusting entries with our comprehensive guide, “Mastering Adjusting Entries Final Exam Answers.” This definitive resource unveils the secrets to mastering adjusting entries, empowering you with the knowledge and confidence to ace your final exam and excel in financial reporting.

Delve into the intricacies of adjusting entries, exploring their purpose, significance, and impact on financial statements. Discover the step-by-step process for recording adjusting entries and unravel the mysteries of adjusting entry worksheets. With real-world examples and expert insights, this guide will transform you into an adjusting entries maestro.

1. Introduction

Mastering adjusting entries is crucial for accurate financial reporting and ensuring the integrity of financial statements. Adjusting entries are accounting entries made at the end of an accounting period to correct and update account balances, reflecting the true financial position of a company.

Adjusting entries are essential for presenting a fair and accurate picture of a company’s financial performance and position. Without adjusting entries, financial statements would be inaccurate and misleading, potentially affecting decision-making and stakeholder confidence.

2. Types of Adjusting Entries

There are several types of adjusting entries, each with a specific purpose and impact:

- Accrued Revenues:Record revenue earned but not yet billed or collected.

- Accrued Expenses:Record expenses incurred but not yet paid or recorded.

- Deferred Revenues:Record revenues collected in advance but not yet earned.

- Deferred Expenses:Record expenses paid in advance but not yet incurred.

- Depreciation:Allocate the cost of long-term assets over their useful lives.

- Amortization:Allocate the cost of intangible assets over their useful lives.

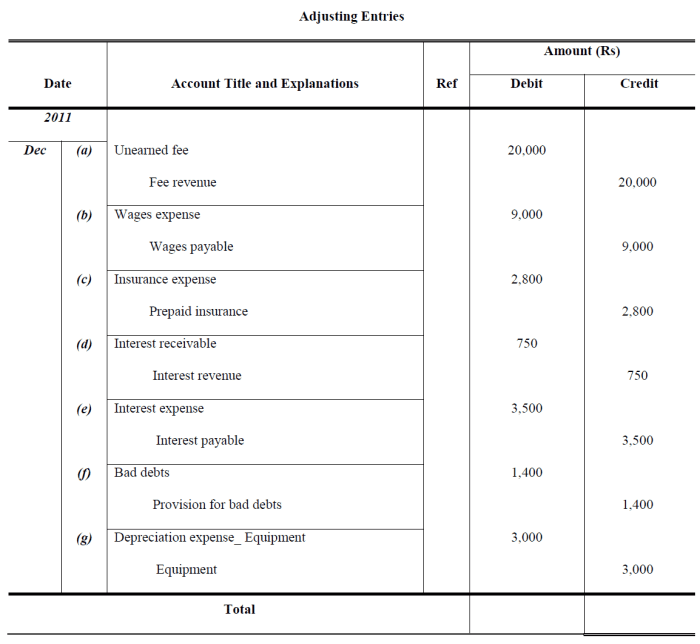

3. Procedures for Adjusting Entries

Recording adjusting entries involves a step-by-step process:

- Identify and analyze transactions:Determine which accounts require adjustment.

- Calculate adjustment amounts:Determine the amounts needed to correct account balances.

- Prepare adjusting entry worksheet:Create a worksheet to record the adjustments.

- Record adjusting entries in the general journal:Post the adjustments to the appropriate accounts.

- Update account balances:Adjust the affected account balances in the general ledger.

4. Examples of Adjusting Entries

| Account | Debit Amount | Credit Amount | Explanation | |

|---|---|---|---|---|

| Accrued Salaries Expense | $1,000 | Salaries Payable | $1,000 | Record salaries incurred but not yet paid. |

| Supplies Expense | $500 | Supplies | $500 | Record supplies used but not yet purchased. |

| Prepaid Rent | $2,000 | Rent Expense | $2,000 | Record rent paid in advance but not yet expired. |

| Depreciation Expense | $1,500 | Accumulated Depreciation | $1,500 | Record depreciation of equipment. |

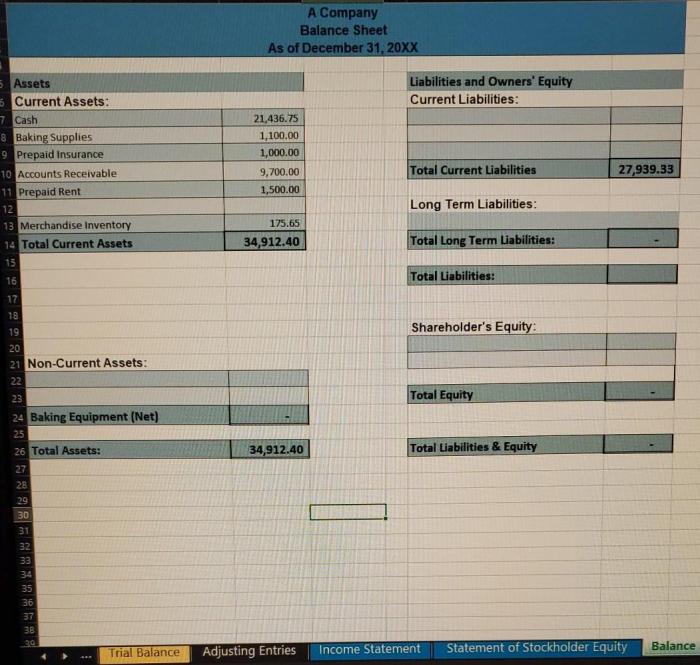

5. Impact of Adjusting Entries on Financial Statements

Adjusting entries significantly impact financial statements:

- Income Statement:Adjusting entries affect expenses and revenues, impacting net income.

- Balance Sheet:Adjusting entries affect assets, liabilities, and equity, providing a more accurate picture of the company’s financial position.

- Materiality:The significance of adjusting entries is evaluated based on materiality, ensuring that only material adjustments are recorded.

6. Common Errors in Adjusting Entries: Mastering Adjusting Entries Final Exam Answers

Common errors in adjusting entries include:

- Incorrect calculations:Errors in calculating adjustment amounts.

- Omission of adjusting entries:Failure to record necessary adjustments.

- Double-counting:Recording the same adjustment multiple times.

- Incorrect posting:Posting adjustments to the wrong accounts.

To avoid these errors, it is crucial to carefully review and verify adjusting entries before recording them.

FAQ Compilation

What is the purpose of adjusting entries?

Adjusting entries ensure that financial statements accurately reflect a company’s financial position and performance at a specific point in time by recognizing revenues and expenses that have occurred but have not yet been recorded.

What are the most common types of adjusting entries?

Common types include accruals (recognizing revenue earned but not yet billed), deferrals (recognizing expenses incurred but not yet paid), depreciation (allocating the cost of long-term assets over their useful lives), and bad debt expense (estimating uncollectible accounts receivable).

How do adjusting entries impact financial statements?

Adjusting entries affect both the income statement and balance sheet. They can alter net income, retained earnings, assets, and liabilities, resulting in a more accurate representation of a company’s financial health.